Bitcoin Hits a New All-Time High: Is $150K the Next Target?

Bitcoin (BTC) has reached a historic milestone once again, smashing past its previous all-time high and reigniting bullish sentiment across the global crypto market. As investors rush to re-evaluate their positions, one question looms large: Is Bitcoin headed for $150,000 next? According to leading market analysts, the answer could be yes—within the next 12 months.

At iFinanceTimes, we’re closely monitoring this momentum. In this article, we break down what’s fueling Bitcoin’s rise, the outlook for 2025, and how savvy investors can prepare for what could be a monumental year.

What’s Driving Bitcoin’s Latest Surge?

Bitcoin’s new price milestone is more than just a number—it’s the result of powerful market forces coming together:

Mainstream adoption: Institutional giants and publicly traded companies are investing in Bitcoin at record levels.

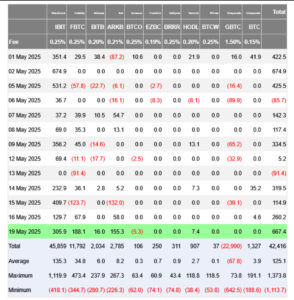

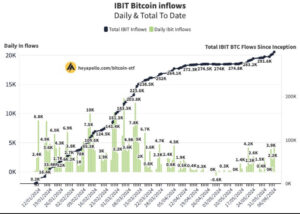

ETF approvals:

The recent U.S. approval of spot Bitcoin ETFs has opened the floodgates for traditional investors.

Macro trends: As inflation and interest rate worries persist, Bitcoin continues to gain ground as a hedge against fiat volatility.

Supply constraints: The April 2024 halving cut Bitcoin’s block rewards in half, decreasing the supply of new coins and amplifying demand.

Is $150,000 in Sight?

Many crypto analysts believe Bitcoin could reach $150,000 by mid-2026—and some even suggest it could happen sooner. Here’s why this isn’t just speculation:

1. The Halving Effect

Bitcoin’s price historically surges after each halving. With fewer coins entering circulation, and more buyers entering the market, scarcity naturally drives prices up. The 2024 halving has only just begun to make its impact.

2. ETF Demand

Spot Bitcoin ETFs now allow institutions to invest billions with the click of a button. This structural shift could mean consistent upward pressure on BTC prices, especially if demand continues to rise.

3. Market Psychology and FOMO

With Bitcoin setting new records, public interest is peaking again. As more retail investors return to the market, the resulting FOMO (Fear of Missing Out) could accelerate price momentum in the months ahead.

What Could Hold It Back?

While the long-term trajectory looks positive, Bitcoin is no stranger to volatility. Here are a few risks to keep in mind:

Regulatory uncertainty: Governments across the globe are still developing frameworks for crypto—this could affect sentiment and adoption.

Short-term corrections: Rapid gains are often followed by healthy pullbacks. Timing your entry matters.

External shocks: Economic instability, geopolitical tensions, or major exchange issues could impact the market.

What Should You Do Now?

If you’re considering investing—or increasing your exposure—it’s crucial to have a plan. Whether you’re a beginner or seasoned investor, understanding the current market dynamics can help you make informed decisions.

Explore our daily updates or get expert insights through our blogs to make the most of this historic opportunity.

Stay Ahead with iFinanceTimes

We deliver real-time updates, expert analysis, and actionable strategies to help you thrive in the evolving world of cryptocurrency.